Buy vs. Rent in San Francisco

Why the Right Answer Isn’t Just About Monthly Payments

Few financial decisions shape a family’s long-term trajectory as much as deciding whether to buy or rent a home, especially in the San Francisco Bay Area, where the price of a “typical” home can easily exceed $2–3 million.

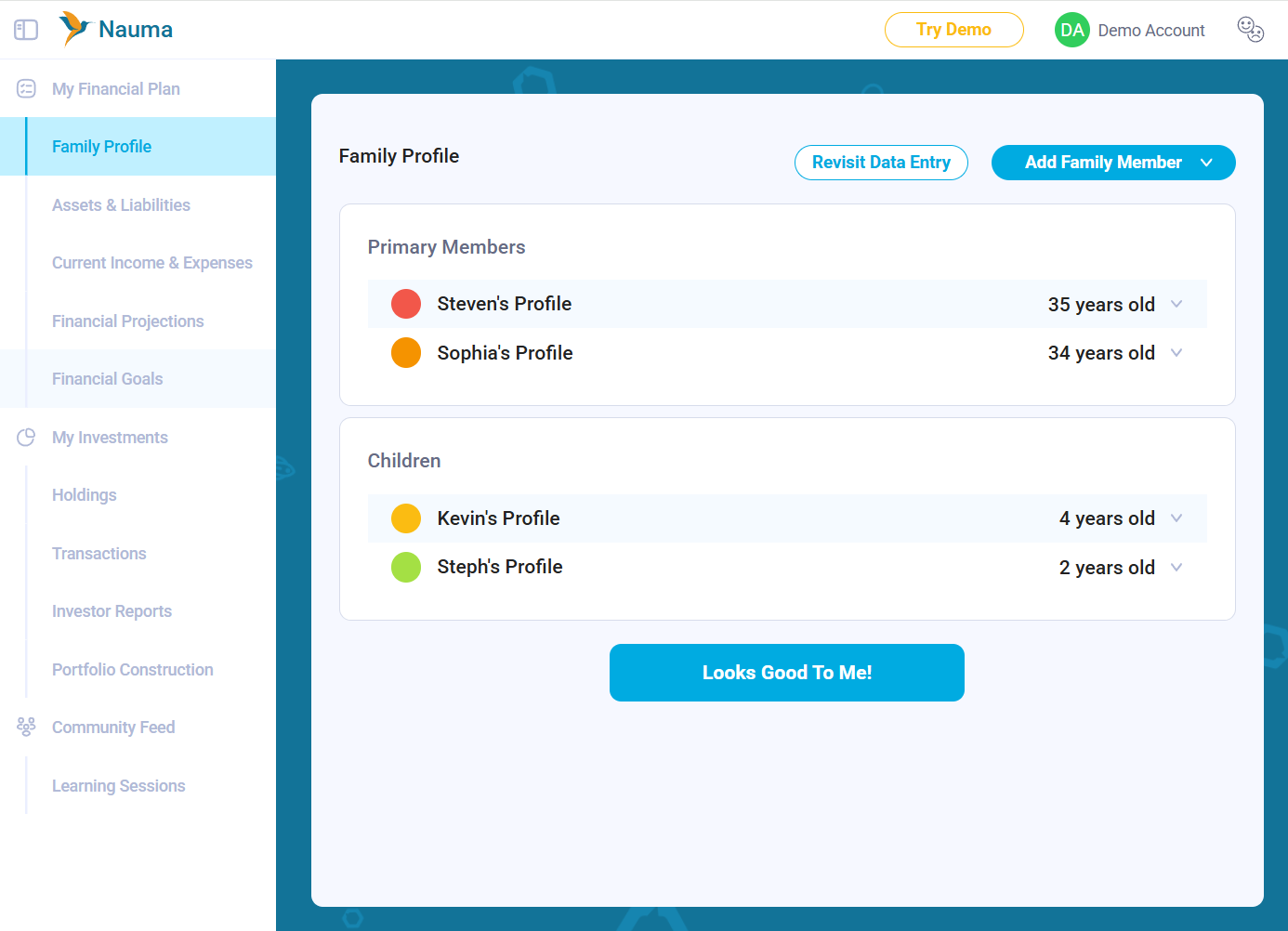

At Nauma, we recently worked with a family in their 30s who faced this exact question.

To answer that, we built two full financial projections. One assuming they continue renting, and one assuming they buy a home. Below is what we discovered and what you should consider if you’re facing the same question.

The Family’s Background

A married couple in their 30s

Both partners work in tech

Have young kids, plan to have more

Net worth: ~$2M

Live in San Francisco and currently rent

The family goal is to build a reliable long-term financial plan that supports raising a family, affording school/college costs, preparing for healthcare expenses, and eventually retiring comfortably.

Scenario 1 — Continue Renting in San Francisco

For the “rent” scenario, we built a full financial projection that included:

Current Financial Picture

We reviewed their complete financial picture—including assets, liabilities, income, and spending—and incorporated future salary expectations, taxes, childcare costs, and lifestyle expenses.

Kids’ Future Costs

We added the future expenses for the kids, including school and college expenses, as well as changes in extracurricular activities and childcare needs over time.

Long-Term Living Expenses

We modeled dozens of spending categories using aggregated data, including groceries, household expenses, and childcare, as well as lifestyle costs that evolve as the children grow. We also accounted for periodic vehicle purchases every 10–15 years, along with travel, entertainment, and other recurring expenses.

Retirement Healthcare

A major factor many families underestimate is how healthcare costs change over time. We separated healthcare expenses and incorporated the following categories into the model:

ACA coverage pre-Medicare

Vision & dental

Medicare Parts A, B, C & D

Long-term care assumptions

Scenario 1 — Projection

Long-term net worth outcomes depend on expected real estate and stock market returns. Historically, the benchmark S&P 500 (with dividends reinvested) has averaged approximately 8.5–10% annual nominal returns. In comparison, from 1999 to 2024, single-family homes in the San Francisco metropolitan area experienced a compound annual growth rate of about 6%.

After discussing the family’s views on stock market and Bay Area real estate returns and plugging the assumptions into the model, the projections showed an $11M net worth (Today dollars) by the end of the financial plan, assuming housing prices do not materially outperform investment returns.

Scenario 2 — Buy a Home in San Francisco

Then, we modified the projection to model a home purchase.

The Assumptions

Home price: ~$3M

Down payment (20%): $600K

Closing costs: ~$50K

Moving + furnishing: ~$150K

Mortgage: $2.4M at 6.25%

Payment: ~$14.8K/month

Homeowners insurance: ~$3K/year

Maintenance: $30K/year

Property tax: 1.1% increasing at Prop-13’s 2% cap

The Hidden Giant: Maintenance

Many homeowners underestimate this category. We estimated ~1% of home value per year, or $30K/year, based on realistic Bay Area costs:

The Surprising Result

Buying the home was financially feasible, but it significantly reduced the family’s long-term net worth. When we compared the two full lifetime projections, the difference was substantial: the expected net worth at retirement (in today’s dollars) was approximately $11M if they continued renting, versus about $5M if they purchased the home.

The $6 million difference is due to:

Higher cash outflow due to mortgage + maintenance

Opportunity cost of the $600K down payment

Property tax

Lower expected return of real estate vs. diversified investments

Long-term drag from high carrying costs

Buying a home did offer lifestyle stability, predictable housing as they aged, and potential emotional benefits but the financial trade-off was clear.

So… Should You Buy or Rent in San Francisco?

Buying a home isn’t always the financially optimal choice. In high-cost markets like San Francisco, ownership can materially reduce long-term net worth even when a family can comfortably afford the purchase. Renting is not ‘throwing money away’; for many tech families, it preserves flexibility, increases liquidity, and can lead to stronger long-term wealth outcomes.

At the same time, finances aren’t the whole story. Families often prioritize school stability, more space for children, control over their living environment, and the emotional security that comes with homeownership. Ultimately, the right decision depends on your financial capacity, life priorities, and risk profile.

How to Make This Decision for Your Own Family

If you’re trying to navigate the Bay Area buy-versus-rent decision, the first step is building a real financial projection—not just a simple spreadsheet, but a comprehensive model that incorporates your income and career plans, long-term expenses, housing scenarios, taxes, healthcare, children’s education, retirement strategy, investment returns, and overall risk capacity. This is exactly where Nauma can help.

Very interesting, I have a few issues with the analysis though.

That is a very high mortgage rate. When mortgage rates are that high, investment returns are typically much higher than 6% - 8.5–10% in the S&P is over what period?

Absolutely loved this analysis, so rare to see at this level of detail! Ramit Sethi would be very happy reading this, haha.