Charitable Donations: A Powerful Tool for Smarter Tax Planning

A practical look at how timing, income, and donation type shape your tax savings.

Most people see charitable giving as a way to help others and support causes they care about.

That’s true – but it can also be a powerful part of your tax strategy.

When done right, charitable donations can lower your tax bill, avoid capital gains, and make every dollar go further.

The Basics: When Is a Donation Tax-Deductible?

To qualify for a tax deduction, your donation must go to a qualified charity, typically a registered 501(c)(3) nonprofit.

You can only claim this deduction if you itemize on your tax return using Schedule A, rather than taking the standard deduction.

When you itemize, charitable donations count alongside other eligible expenses such as state and local taxes (SALT) and mortgage interest on your primary home. However, if your total itemized deductions don’t exceed the standard deduction, your charitable gifts won’t actually reduce your taxable income that year.

That’s why many people choose to “bunch” donations — making a larger contribution in a single year instead of spreading smaller gifts across several years. This strategy helps push total deductions above the standard threshold and allows your charitable giving to deliver real tax savings.

Two Common Ways to Donate

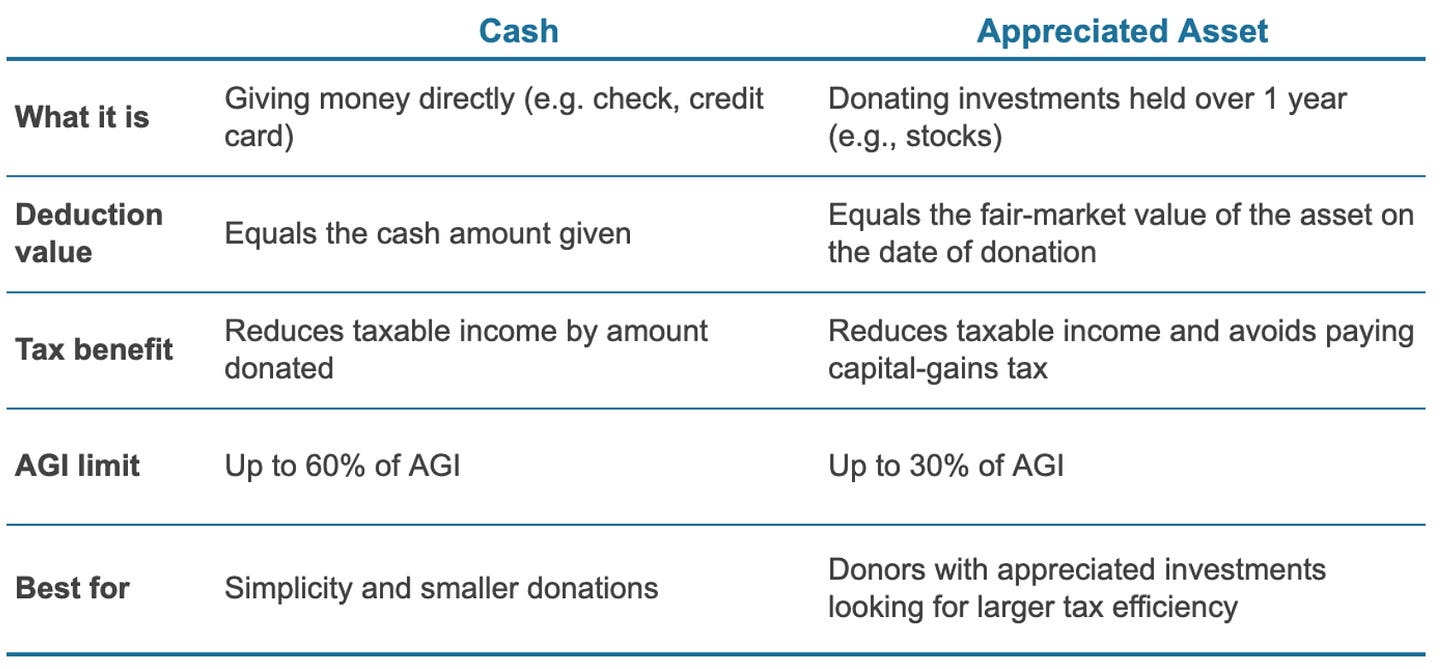

When it comes to charitable giving, the two most common methods are cash donations and donations of appreciated assets such as stocks, ETFs, or mutual funds.

The table below summarizes the key differences between the two:

An Illustrative Example

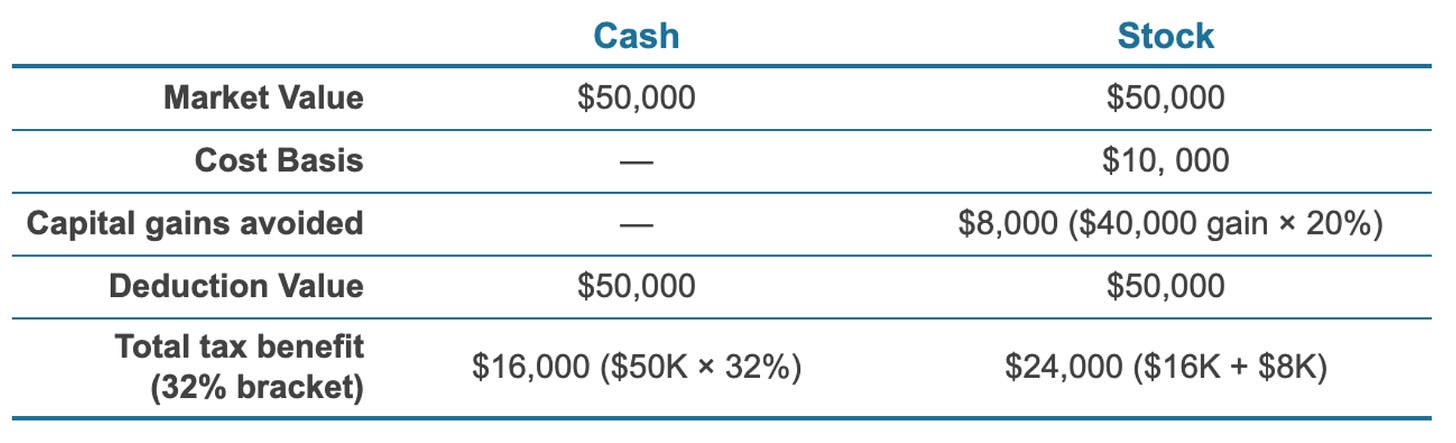

Let’s look at a simple example comparing a $50,000 cash donation to a $50,000 stock donation.

If you give cash, your deduction equals the amount donated, i.e. $50,000. Assuming you’re in the 32% tax bracket, that saves you about $16,000 in taxes.

Now, suppose instead you donate appreciated stock worth $50,000 that you originally bought for $10,000.

If you were to sell the stock first, you’d owe capital gains tax on the $40,000 gain and about $8,000 long capital gain tax at a 20% rate.

By donating the stock directly, you avoid that tax and still deduct the full $50,000 market value.

In total, your tax benefit jumps to $24,000 ($16,000 deduction savings + $8,000 avoided capital gains).

A Comprehensive Case Study: The Long-Term Impact of Charitable Giving

While the illustrative example makes the math clear, it’s also oversimplified. It looks at just one year, assumes a fixed tax bracket, and doesn’t consider how income, deductions, or portfolio values change over time.

To see the full picture, let’s look at a long-term projection.

Let’s consider a couple in their late 30s with two children and several long-term goals. Their financial snapshot looks like this:

Annual household income: $350,000

Net worth: Approximately $2.2 million split between taxable, retirement, and real estate assets.

Ongoing expenses: living expenses, mortgage payments, property taxes etc.

Financial goals:

Fund college education for their two children

Prepare for retirement

Plan for potential long-term care needs later in life

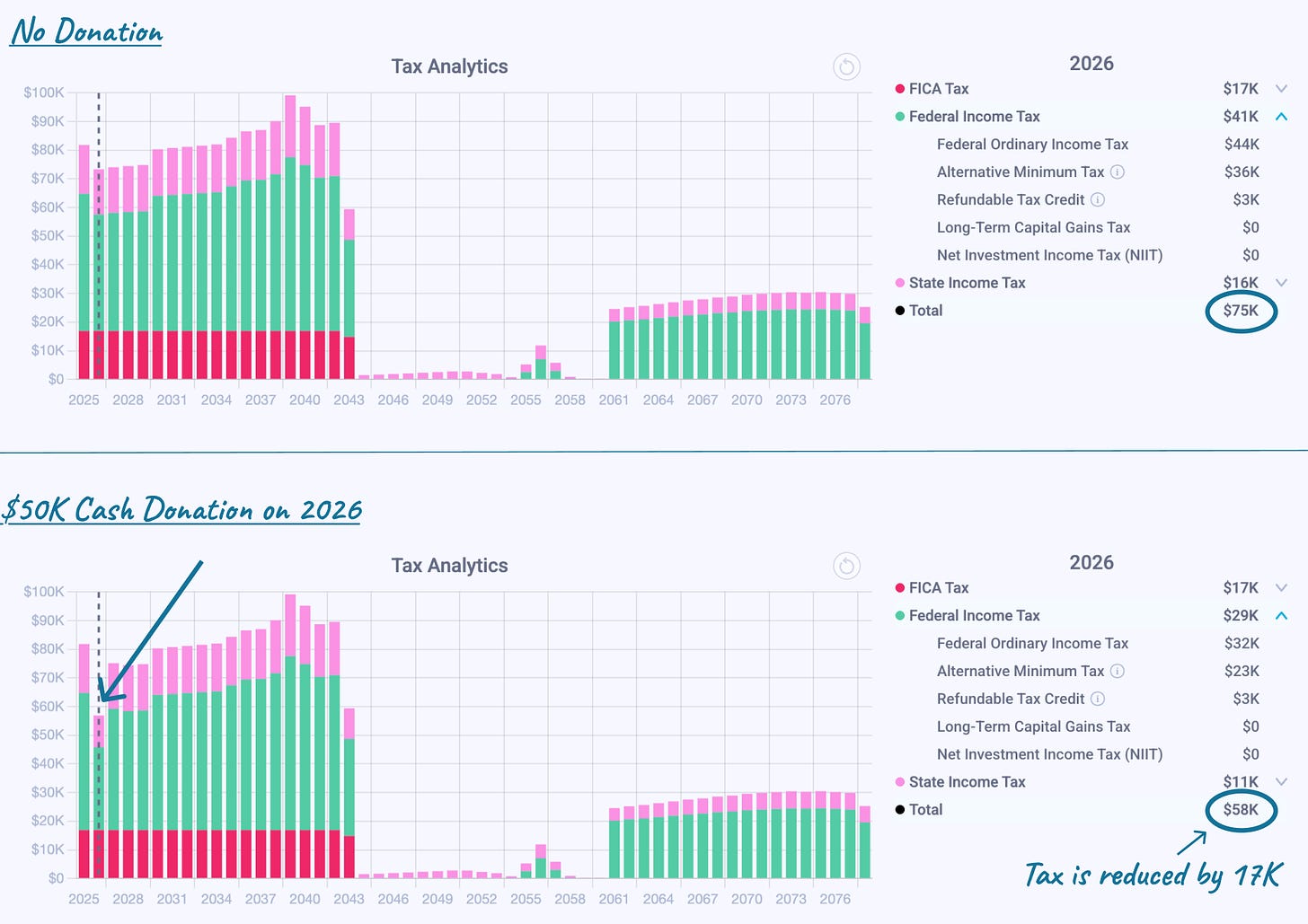

Case 1: cash donation of 50K in 2026

Let’s start with a one-time $50,000 cash donation in 2026.

Without the donation: total tax for 2026 is about $75,000

With the donation: tax drops to $58,000

Saving $17,000 on tax with the donation

In the projection, the donation barely affects their overall cash flow — it shows up as a small, one-year expense — but the tax benefit is immediate and significant. The deduction lowers their taxable income and reduces their federal tax bill for that year.

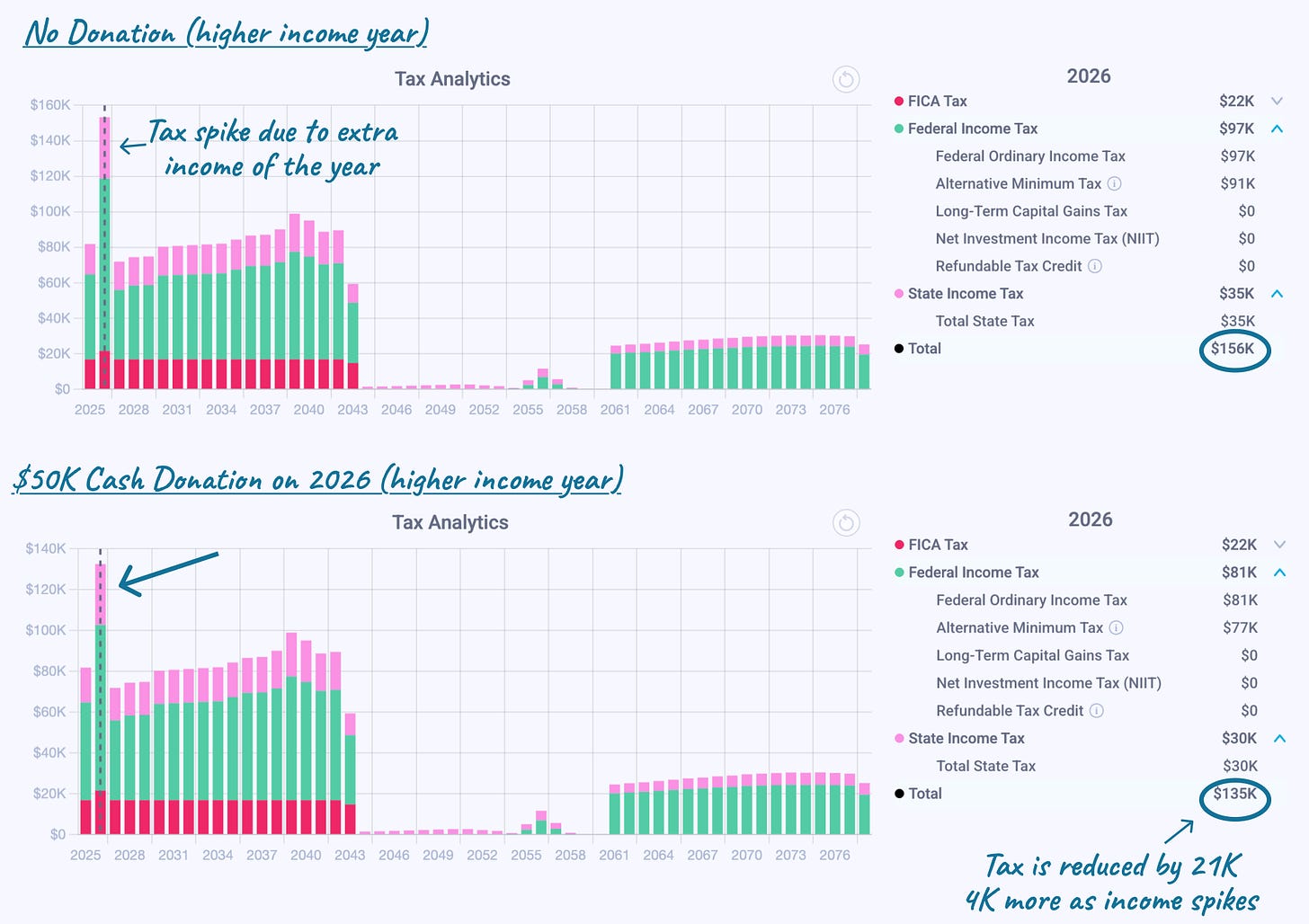

Case 2: Higher-Income Year — Cash Donation with a $200,000 Bonus

Now let’s see what happens if the couple’s income spikes in 2026. For example, one spouse receives a $200,000 bonus or a large investment is sold that year.

This higher income pushes them into a higher marginal tax bracket, meaning every additional dollar they earn is taxed at a steeper rate. In that situation, a charitable deduction becomes even more valuable.

Using the same $50,000 cash donation:

Without the donation, their projected tax bill for 2026 rises to about $156,000.

With the donation, it drops to $135,000.

Saving $21,000 tax, 4K more compared to $17,000 in the base case.

The difference shows how timing matters — giving during a high-income year amplifies the impact of your deduction. When your income (and tax bracket) are elevated, the same charitable gift can deliver a larger after-tax benefit.

Case 3: Liquidity Constraints and Their Hidden Tax Effects

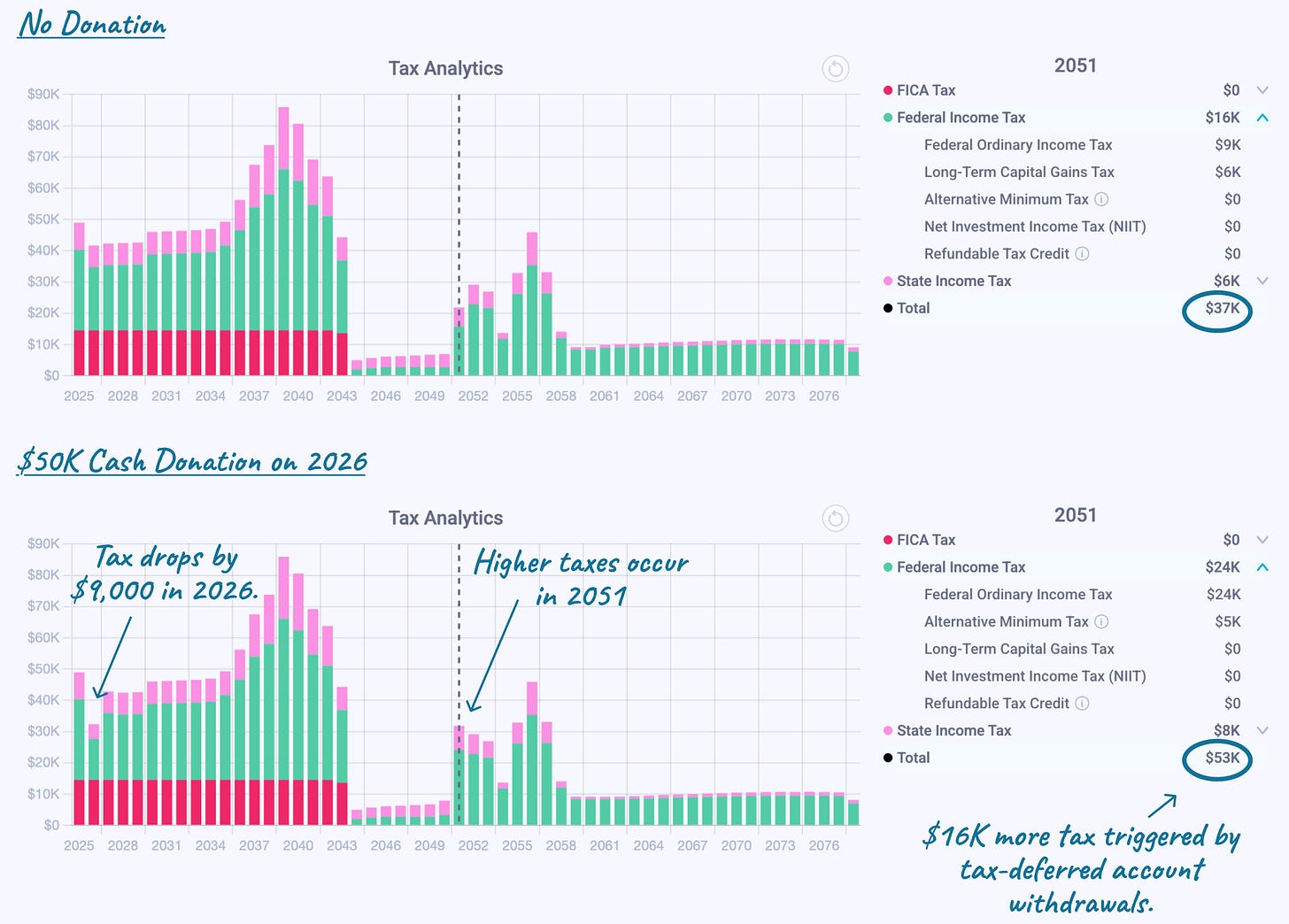

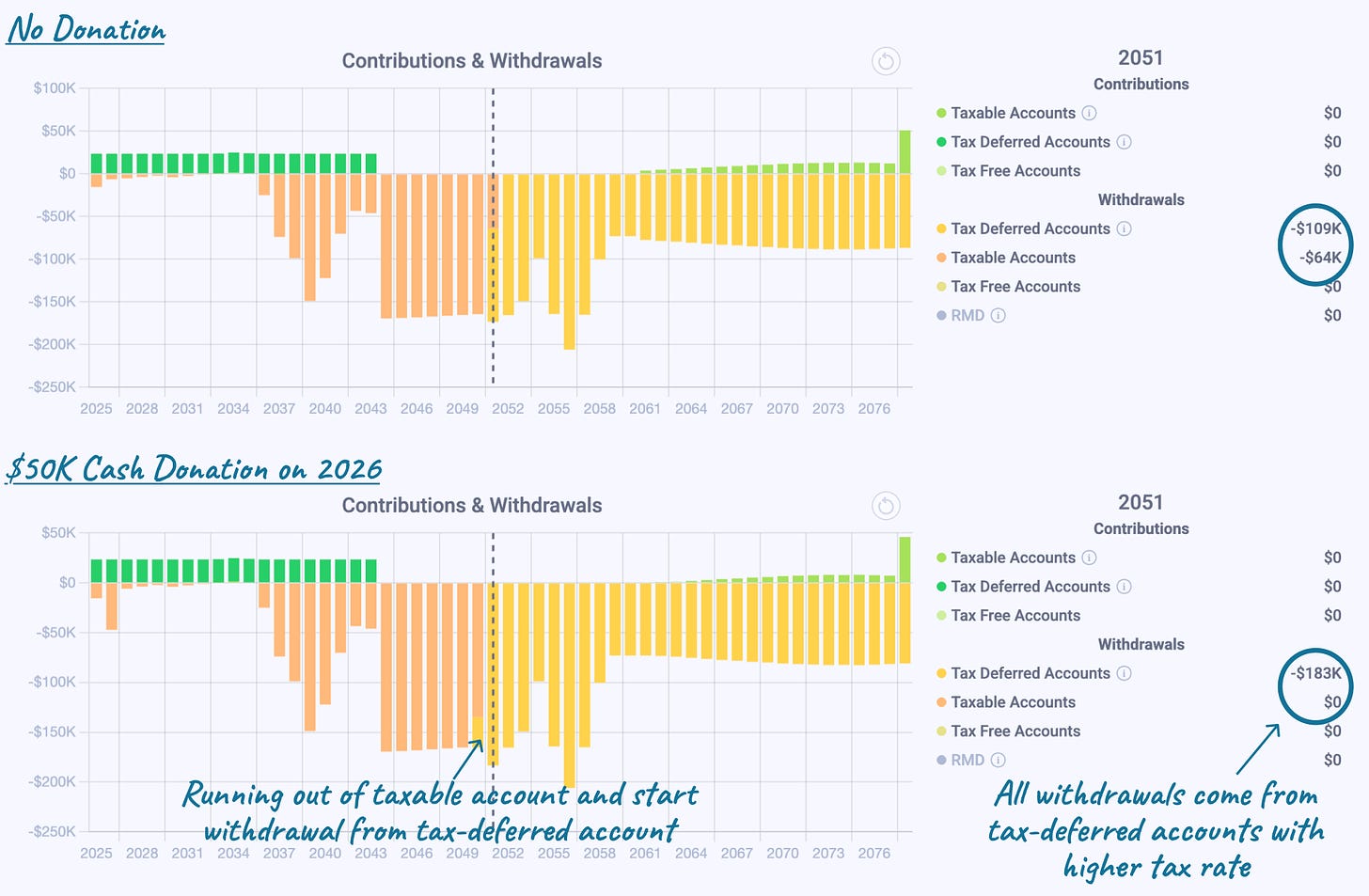

Now, let’s look at a different dynamic — a scenario driven by lower liquidity.

For simplicity, we model this by reducing the couple’s income by $100,000 before retirement. This lowers their annual net cash flow and, in turn, their ongoing contributions to taxable accounts over time.

Over time, however, the donation reduces their liquid savings, leaving less flexibility later in life. In our projection, their taxable account is depleted around 2051, forcing them to draw from tax-deferred accounts earlier than planned. Those withdrawals are taxed as ordinary income, increasing their tax liability in later years.

So while the donation provides an immediate tax benefit, it also creates long-term ripple effects. The same liquidity issue can arise even for high-net-worth households, especially when much of their wealth is tied up in real estate or other illiquid assets. Understanding how a donation affects your liquidity and withdrawal strategy is essential for managing long-term tax outcomes.

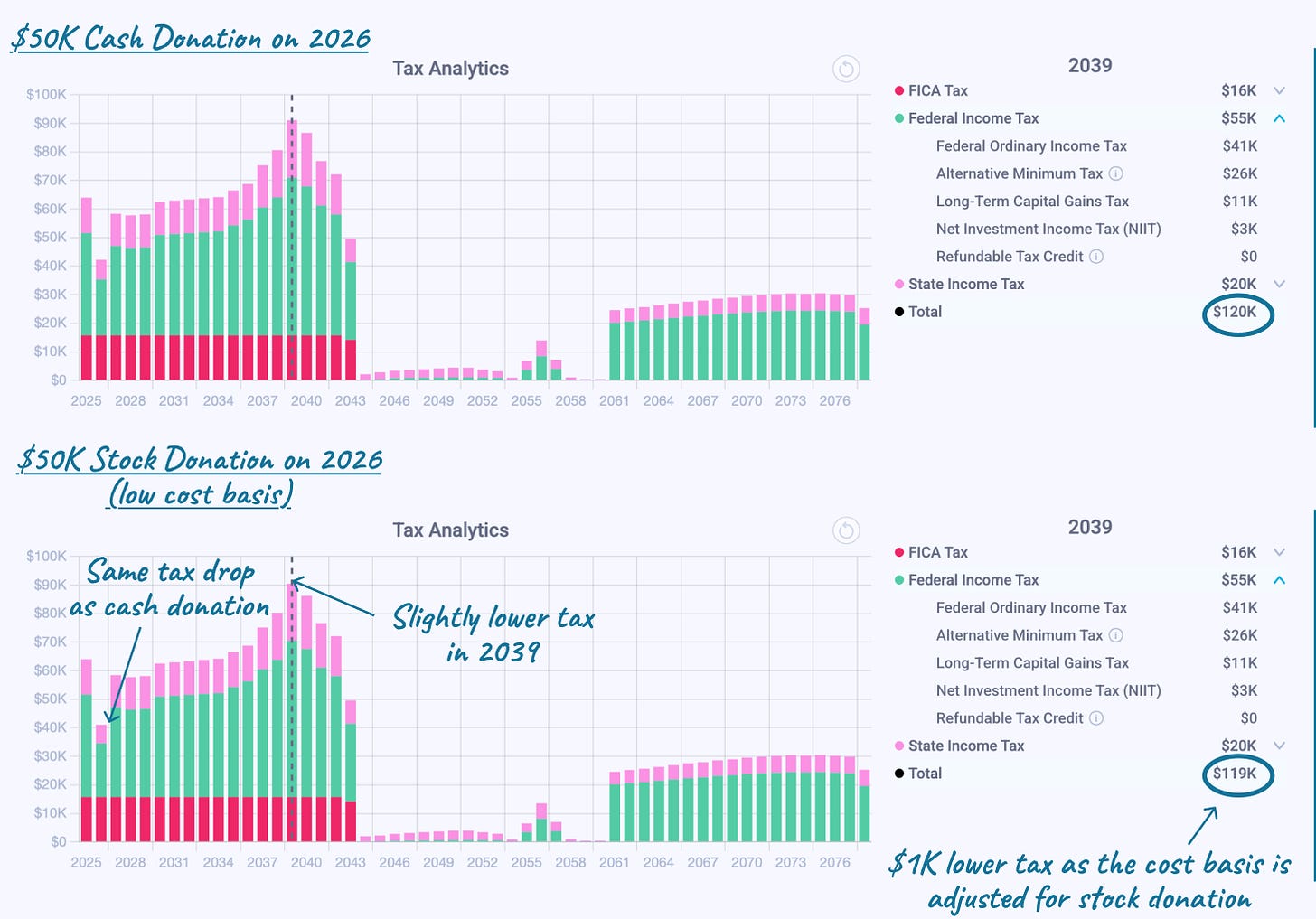

Case 4: Cash vs. Asset Donation

Finally, let’s compare donating cash versus appreciated assets, such as stocks or ETFs that have increased in value over time.

When the couple donates $50,000 in cash, the tax benefit appears immediately, as seen in earlier examples. But when they donate $50,000 in appreciated assets with a much lower cost basis, in addition to the immediate effect, something more subtle happens over the long term.

By giving investments with built-in capital gains, the overall cost basis of their remaining taxable portfolio rises. As a result, future withdrawals from these accounts generate smaller capital gains, and therefore less tax over time.

In our projection, this difference becomes visible in 2030, a year with significant withdrawals:

With asset donation: total tax is about $19,000

With cash donation: total tax is about $20,000

That’s roughly a $1,000 difference for that year. In the projection, we use the average cost basis to estimate taxes. In fact, the difference appears in every year the couple withdraws from their taxable account, and the actual impact depends on how much they withdraw each year.

In short, donating appreciated assets creates layered tax savings, first by avoiding capital gains when the gift is made, and later by reducing taxable gains in future years.

Summary: When Charitable Giving Makes the Most Sense

As we see from the cases, the impact of charitable giving depends on timing, income level, liquidity, and what you give.

Higher income = bigger benefit.

When your income (and tax bracket) rises, for example from a bonus, investment gain, or business sale, each dollar of deduction saves you more in taxes. That’s the ideal time to make charitable gifts.

Itemizing amplifies the impact.

If you already itemize deductions, such as mortgage interest or high state and local taxes, charitable donations stack directly on top, making them far more valuable than in years you take the standard deduction.

Liquidity matters.

Even wealthy households can face tax ripple effects when most of their assets are tied up in real estate or other illiquid investments. Donating from liquid, taxable accounts reduces flexibility and may lead to higher taxes later when you’re forced to draw from tax-deferred accounts. Always consider how a gift affects your long-term cash flow and withdrawal strategy.

Donating appreciated assets multiplies the savings.

Contributing investments instead of cash lets you avoid capital gains tax while deducting the full market value. It also improves your future tax position by raising the cost basis of what remains in your portfolio.

By understanding these principles and planning strategically, you can make a bigger impact — for both the causes you care about and your long-term financial future.

Want to see how these projections look in action?

Here is a step-by-step demo of how giving strategically can lower your taxes and shape your financial plan.