Impact of Deferring Capital Gain Taxes

Why wealthy investors focus on delaying capital gains and where people get it wrong

Most investors focus on returns, but for high-net-worth households, taxes often matter just as much as market performance. In this post, we’ll discuss why deferring capital gains in taxable accounts can increase after-tax wealth and how this differs from tax-deferred accounts.

Taxable Accounts

If we look at what financial advisors do for their high-net-worth clients, we’ll notice that many tax-aware strategies attempt to delay paying capital gains taxes in taxable accounts. Very few people understand why this is important or how it works.

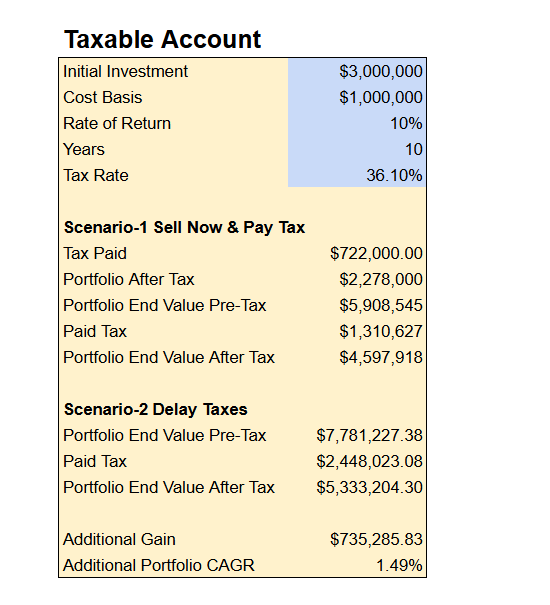

Here’s a simple example. Suppose an investor has a $3M concentrated stock position that they are not comfortable holding. The cost basis is $1M. For simplicity, assume the investor’s long-term capital gains tax rate does not change over time and remains 36.1% (20% federal, 3.8% NIIT, 12.3% California state), whether the stock is sold today or 10 years from now.

Current Portfolio = $3M

Cost Basis = $1M

LTCG Tax Rate = 36.10%

Expected Rate of return = 10%

Years = 10

In the first scenario, the investor sells the concentrated position now, pays taxes, reinvests in a diversified fund, and exits the market after 10 years:

Tax Paid Today = $722K

Portfolio After Tax Today = $2.28M

Cost Basis Today = $2.28M

Portfolio Value Pre Tax 10 years later = $5.90M

Portfolio Value After Tax 10 years later = $4.5M

In the second scenario, the investor uses tools that allow them to diversify while deferring capital gains taxes, then exits the market after 10 years:

Cost Basis Today = $1M

Portfolio Value Pre Tax 10 years later = $7.78M

Tax Paid in 10 years = $2.44M

Portfolio Value After Tax 10 years later = $5.33M

By delaying taxes in a taxable account, the investor increases their expected after-tax portfolio value. In this example, over a 10-year period with a 10% annual return and a 36.1% LTCG tax rate, the investor generates an additional $735K in after-tax value, equivalent to increasing their post-tax growth rate by ~1.5% per year.

Don’t Let Taxes Mismanage Your Investment Risk

While delaying the realization of capital gains in taxable accounts can be powerful, it should never come at the expense of proper diversification.

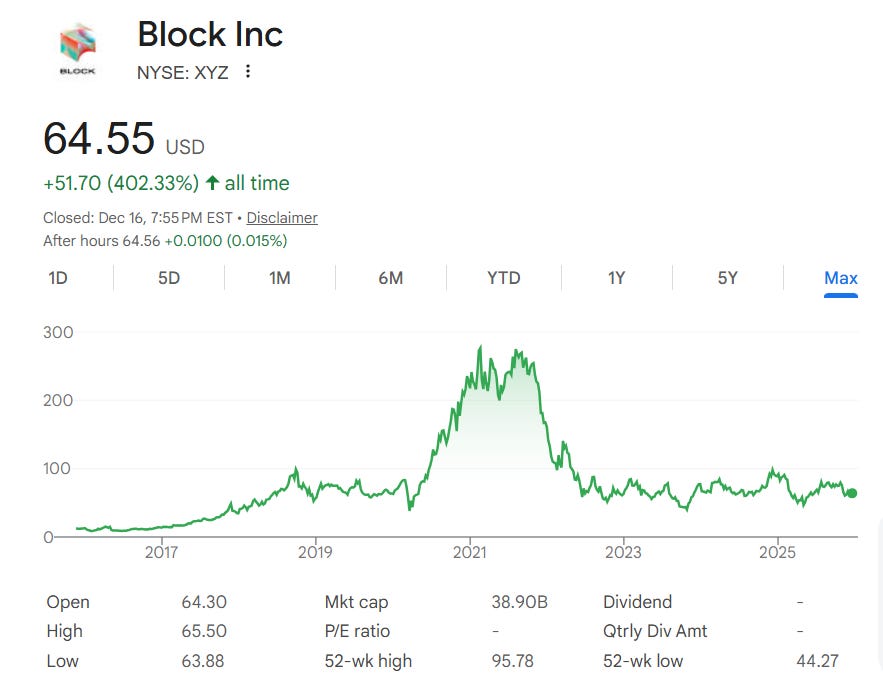

Consider the case of Block, Inc., a fintech company best known for Square, Cash App, and its crypto-related products. The company went public in 2015 under the name Square and later rebranded to Block. During the 2021 tech bull market, the stock reached an all-time high, fueled by growth expectations and enthusiasm around fintech and Bitcoin. In the years that followed, the stock experienced a significant drawdown, lost around 75% of its value and never recovered since then.

Tax-Deferred Accounts Work Differently

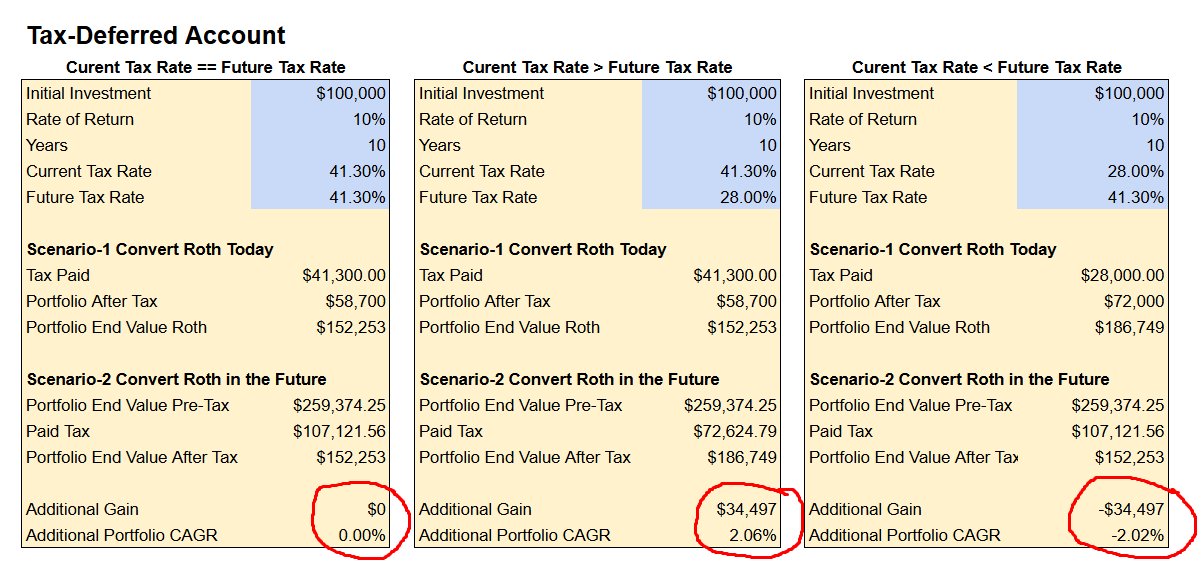

Taxable and tax-deferred accounts work differently. Sometimes people hear about strategies that apply to one type of account and automatically try to apply them to another, which is incorrect.

In taxable accounts, capital gains taxes are applied to the difference between the current portfolio value and the cost basis. In contrast, in tax-deferred accounts, ordinary income taxes are applied to the entire account balance when money is withdrawn or converted to a Roth account. Once money is converted to a Roth account, it is never taxed again.

This means that there is no difference between doing a Roth conversion (and paying taxes) today or in the future, as long as the current and future tax rates remain the same.

The decision of whether to convert to Roth today or later is usually based on the investor’s expectations about their future ordinary income tax rate. If an investor anticipates being in a lower marginal tax bracket later, it makes sense to delay the conversion until that time. If the investor believes that their current marginal tax rate is lower than it will be in the future, they might want to consider doing a Roth conversion now.