Retire in the Bay Area or Relocate to Florida?

A Side-by-Side Look at Long-Term Net Worth

Many families who built their fortune in San Francisco often think whether they should stay here for the rest of their lives.

We recently worked with a family, and one of the questions they wanted to answer was where they should spend their retirement. Their kids will be heading to college in a couple of years, giving them more flexibility around where they live. One of the options they’re considering is moving to Florida. How would moving to a different state affect their financial situation?

To answer this, we built several financial models that gave the family insights and helped them make a decision.

In this post, we’ll walk through a hypothetical example to show how you can build similar models yourself and understand how a move like this could affect your long-term net worth.

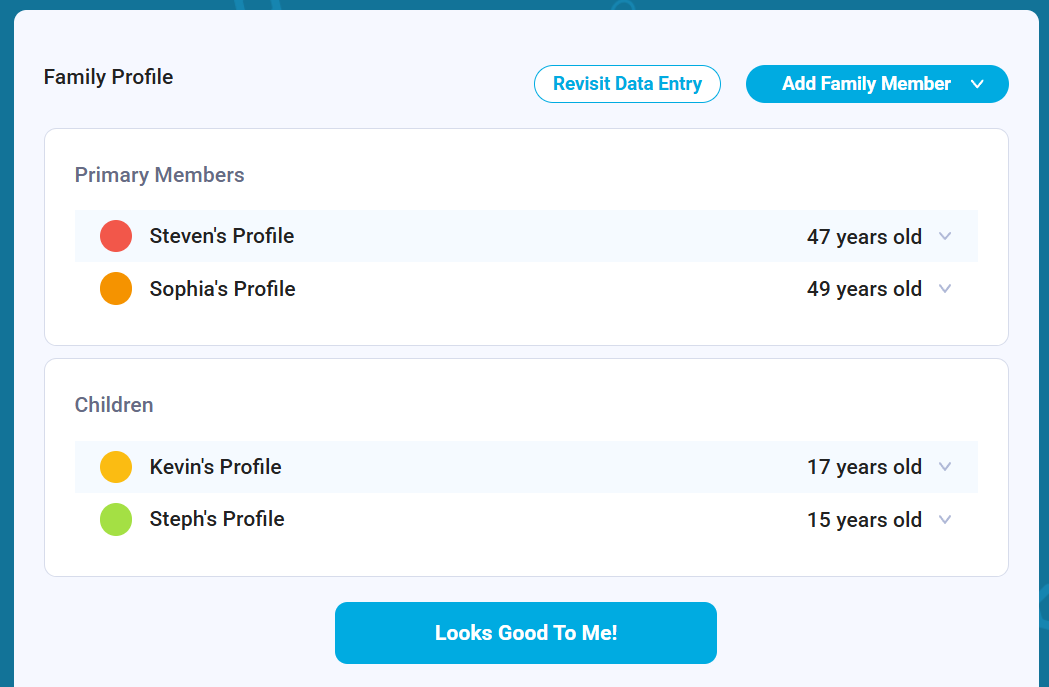

Hypothetical Family Profile:

The family lives in the San Francisco Bay Area

Steven (47) works in a top tech company and earns $530K/year

Sophia (49) works in tech too and earns $270K/year

They have two kids: Kevin (17) and Steph (15)

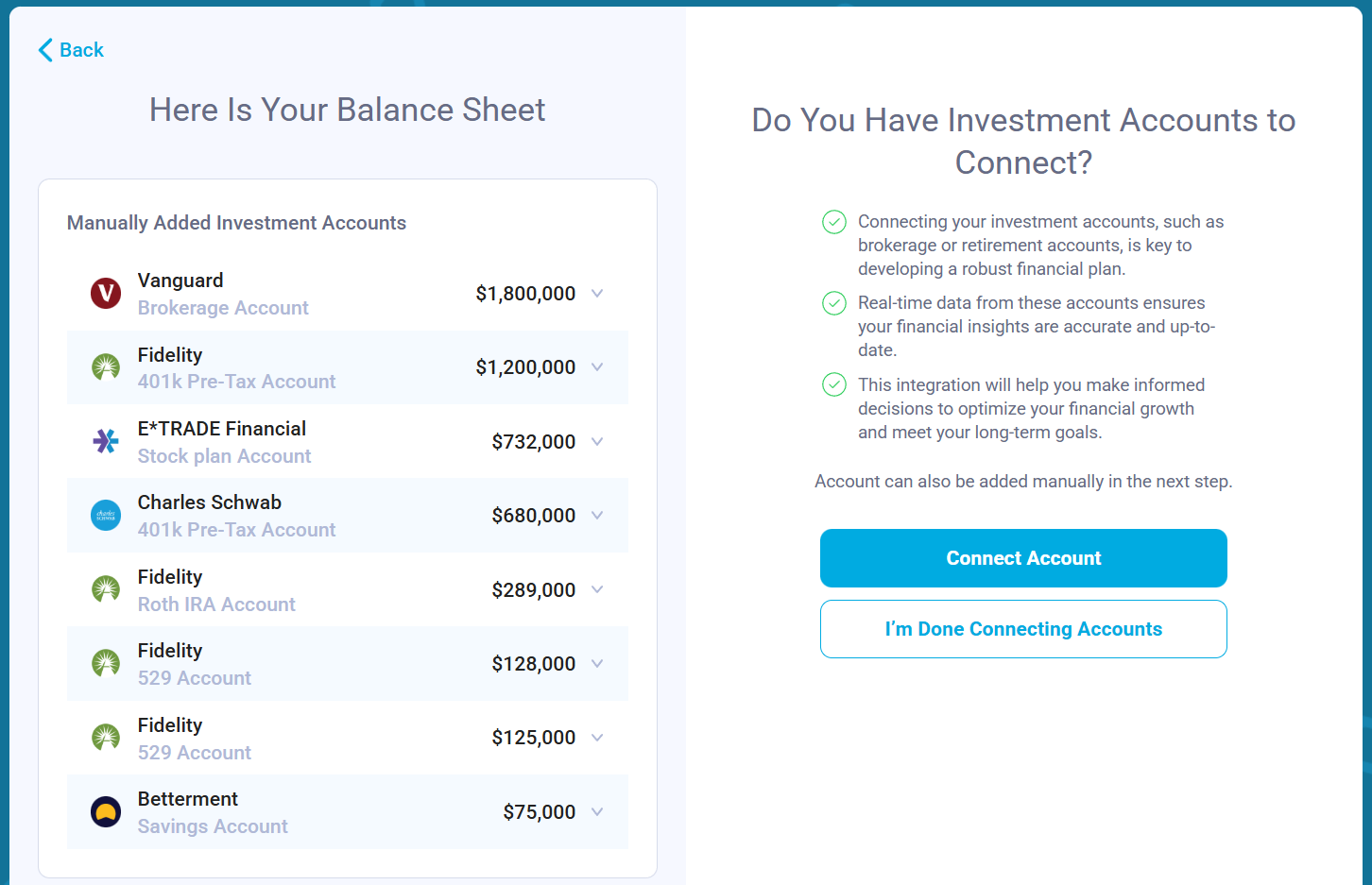

The family net worth is $6.4M:

$2.6M in taxable accounts (cost basis $1.35M)

$1.88M in tax-deferred accounts

$542K in tax-free accounts (Roth and 529)

They own a house worth $2.2M which they bought for $1.6M in 2016

Mortgage balance is $887K: 2.65% for 30 years taken in 2021

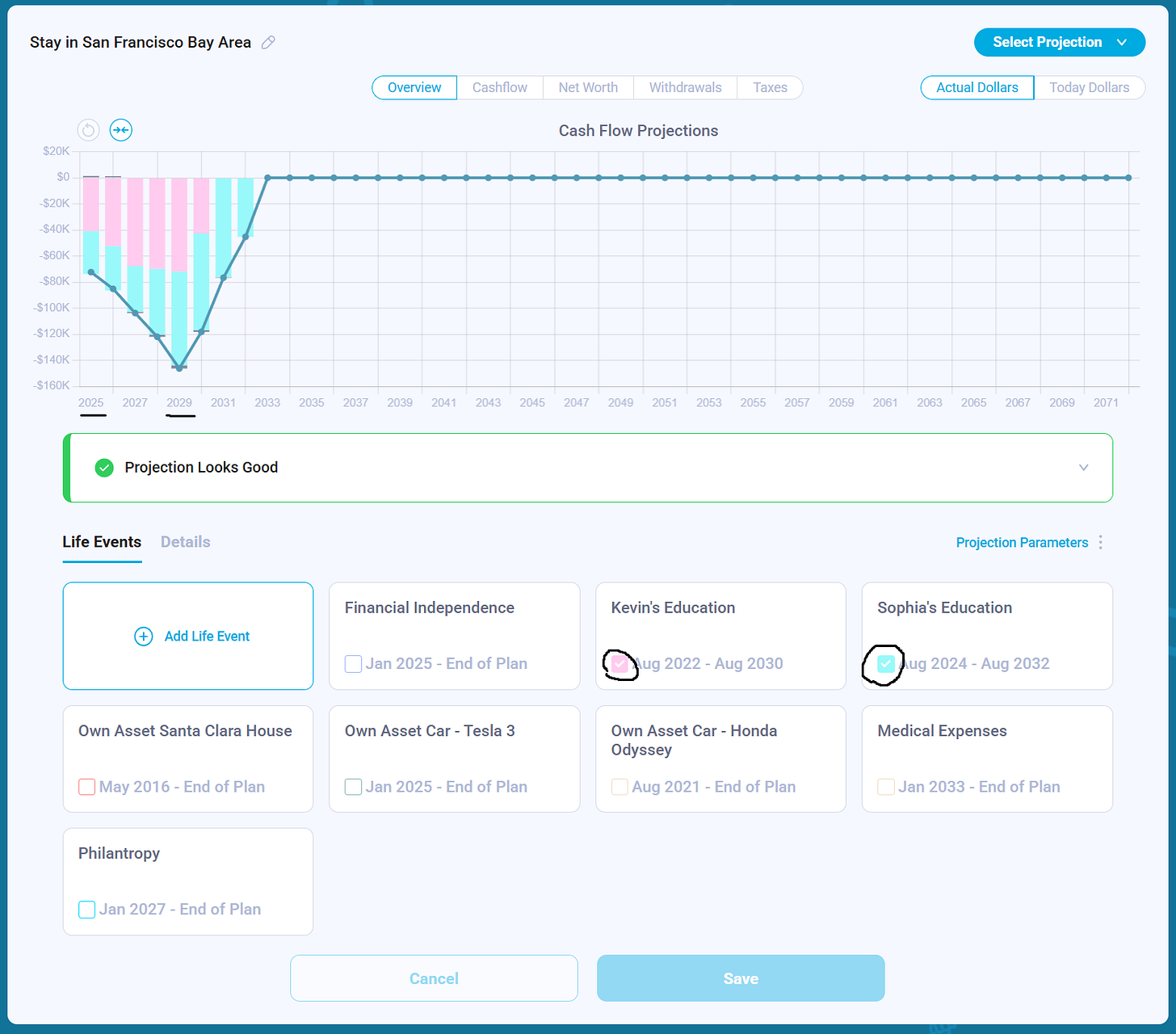

Scenario 1 – The Family stays in The Bay Area

We mapped all their future income and expenses on a timeline, assuming they stay in the Bay Area.

Their house will require ongoing payments for property taxes, insurance, mortgage, and maintenance.

Living expenses will decrease once the family stops working (Sophia plans to retire in 4 years, and Steven in 7 years).

After they stop working, they will need to purchase their own medical insurance until they transition to Medicare at age 65.

We also included the expected long-term care expenses for both partners.

Kevin will go to college in 2026, and his AAA travel team expenses will end.

Steph will go to college in 2028, and her lessons will end at that time.

The family plans to fund their DAF with appreciated stock in 2027 and benefit from the charitable deduction.

They own a couple of cars and plan to replace them every 10 years.

Things in this plan will certainly change over time, but mapping them out on a timeline helped the family better understand their major future expenses and have a meaningful conversation about what they truly want in life and the lifestyle they envision.

When we build financial projections, we’re not trying to predict the future, but rather to set the direction and work toward it.

One of the things that made the family reluctant to give up their current high income was the variability of school and college expenses. They mentioned this as a concern during our discussion. The lack of clarity and the unpredictability of these costs led them to believe they needed to continue working until their children graduated from college.

We helped the family better understand these expenses and added them to the timeline. This allowed them to visualize and start estimating how much they would need to set aside for school and college costs, taking into account inflation, expected investment returns, and taxes (with some savings in regular taxable accounts and others in tax-advantaged 529 plans).

The model has shown $9M net worth (right chart) at the end of the financial plan. Green bars represent liquid assets, yellow bars mean non-liquid assets. We can see that with all the assumptions about income, expenses, taxes and investment returns the family is expected to use almost all their liquid assets if they stay in the San Francisco Bay Area:

Scenario 2 – The Family moves to Florida

The family is considering moving to Sarasota (FL) and we used zip code 34238 when fetching data for living expenses, health insurance and other expenses.

When estimating living expenses, we used MIT Living Wage Calculator and Payscale data. These sources gave us a reduction between 29% and 42% depending on family size and their employment. For our family we used a more conservative 20% reduction in living expenses because we separate medical expenses, taxes and primary residence expenses in our models.

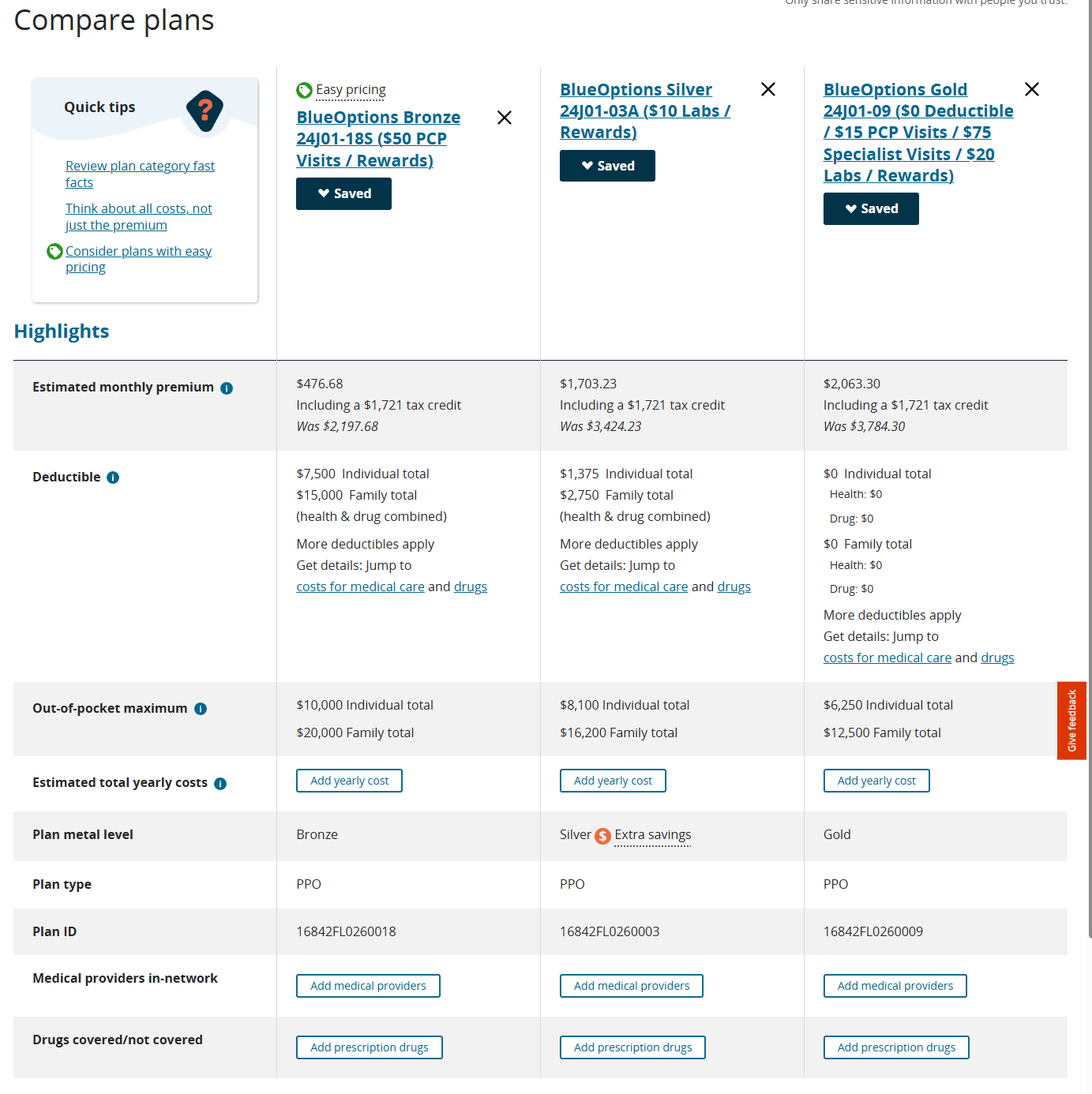

We use healthcare.gov data to estimate ACA health insurance costs in both California and Florida. The family is considering moving in 2028, so we increased the age of each partner by 2 when entering the data on the website and set their income to be $50K assuming that they won’t work in the future.

BlueOptions Bronze,Silver, Gold plans gave us $476/month, $1703/month, $2,063/month. We estimated the total annual expense as a monthly premium x 12 + MOOP (Max Out Of Pocket). We picked the Silver Plan in our model and that gave us $36.6K/year which is very conservative because it assumes that the family will be maximizing their MOOP every year.

Long Term Care (LTC) In Florida is less expensive than in California: $155K/year vs $182K/year private room and $63K/year vs $88K/year assisted living community. For this family we used in-home care option and reduced the LTC cost accordingly:

We planned the move for September 2028, when Steph goes to college. At that point, the family will sell their home in California. We updated the model to stop the mortgage in 2028 and added $2.2M in sale proceeds. Their cost basis is $1.6M, and with the $500K Section 121 exclusion for married couples filing jointly, we increased the adjusted cost basis accordingly. We also included closing costs equal to 6% of the sale price.

The family plans to rent in Florida for a year to give themselves time to explore neighborhoods and find the right home. After that, they expect to buy a place for around $540K. They don’t plan to take out a mortgage, since the proceeds from selling their current home should be enough to cover the purchase.

One important item to consider is the high cost of insurance in Florida, especially in coastal areas. We increased their estimated insurance from $2,500/year to $12,000/year. Coastal homes, particularly those in hurricane- and flood-prone zones, often face significantly higher premiums due to wind and water-damage risk and stricter building-code requirements.

To update the tax estimates accordingly, we added a new milestone to the family’s Financial Projection called “Relocate to Florida” and attached a Tax Config to it. This tells our tax model to begin calculating state taxes as if the family resides in Florida starting in 2028.

If the family moves to Florida, they expect to stop working in tech that same year. Changing states and ending their income both affect their estimated taxes. The model automatically calculates the family’s income taxes in both scenarios. We didn’t need to calculate anything manually:

Let’s compare scenarios

The model makes many assumptions about future income, expenses, and investment returns. But given that everything else remains the same and only the changes described above are applied, the family is projected to have a net worth of $9M at the end of the financial plan if they stay in the Bay Area.

If the family moves to Florida, they stop working in 2028 instead of 2033 (gaining five years back), and their net worth is projected to be $11M at the end of the plan.

Also, the family assets are going to look much differently. If they stay in the Bay Area, they are expected to spend all their savings in taxable, tax-deferred and tax-free accounts. It’ll be primarily their real estate which is left at the end of the financial plan.

If the family moves to Florida, they are expected to have a healthy mix of taxable, tax-deferred and tax-free savings and will be able to pass assets down to their heirs.

Conclusion

Deciding whether to stay in the Bay Area or relocate to Florida is ultimately a personal choice. Financial modeling can highlight the trade-offs: lower taxes, reduced living costs, and an earlier retirement timeline in Florida versus the familiarity, community, and opportunities that come with staying in San Francisco, but numbers alone can’t make the decision.

What the model can do is give families clarity. By mapping out income, expenses, taxes, healthcare, housing, and long-term care needs across both scenarios, this family was able to understand how each path might shape their financial future.

Every family’s values, preferences, and life priorities are different. Some will choose financial optimization; others will choose proximity to friends, career opportunities, or simply the lifestyle they enjoy most. The right answer is the one that aligns with what matters to you.

If you’d like to build your own projections and explore scenarios like this, you can give Nauma a try.

Very thorough but regardless we're staying in N. CA!