What If You’re Already Have Enough to Stop Working?

Why millions of families are working years longer than needed because they follow outdated financial advice.

People who rely on the 4% rule to decide when to stop working are likely over saving and staying in the workforce longer than necessary.

Let's consider this example:

A married couple living in California

Both partners work and contribute to their retirement accounts

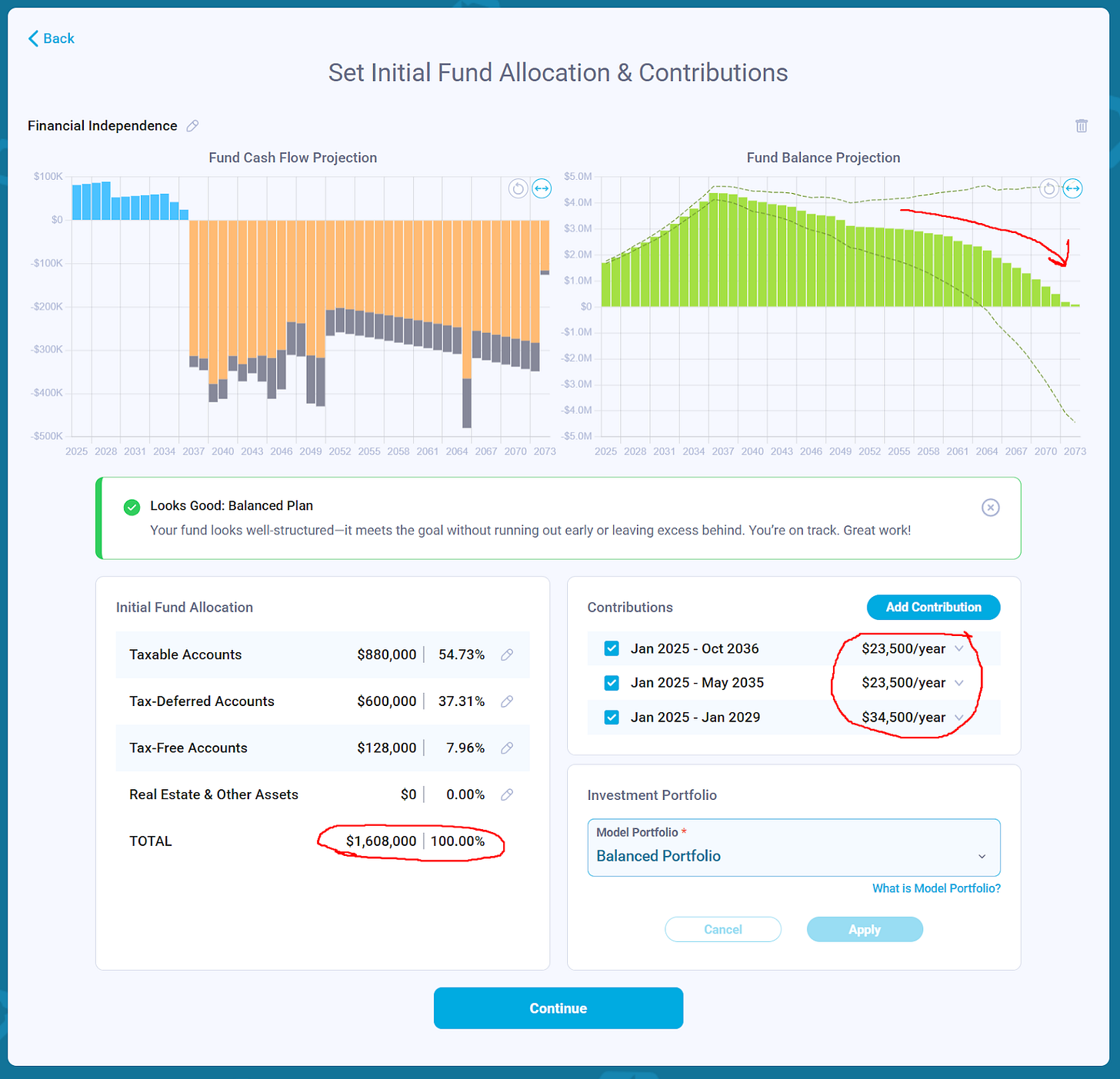

They’ve already saved $1.6M for retirement: $880K in taxable accounts, $600K in tax-deferred accounts, and $120K in tax-free accounts

They plan to work for another 10 years, until 2036, continuing to contribute to their retirement accounts

The family knows they will need to cover approximately $330K per year in expenses from their savings starting in 2036 when they stop working. Using the 4% rule, they estimate their portfolio will need to be about $8.2M by 2036, which is equivalent to $5.9M in 2025 after adjusting for 3% inflation.

They look at their savings rate and realize that their retirement portfolio will grow to only about $4.6M by 2036, assuming a 7% annual growth rate and no change in their current savings rate. To reach $8.2M, they would need to work an additional 7 years unless they significantly increased their savings rate. That's what the 4% rule tells them.

However, the 4% rule only ensures that a portfolio won’t run out of money over a 30-year retirement. It doesn’t consider how much money might be left over in the accounts at the end.

If this couple manages their retirement fund well and intentionally spends down their portfolio to $0 by the end of their retirement, they wouldn’t need $8.2M by 2036. Their projected $4.6M could be enough. Dave Ramsey could be right when he says that people should withdraw 8% annually from their savings accounts (in our example the couple would be withdrawing $330K/$4.6M = 7.1%). But there’s an important caveat: this only works if they know how to manage their portfolio effectively to spend it down gradually and safely.

The problem is that most people can’t do this today: Market volatility and sequence risk make bringing a portfolio to zero a non-trivial job for regular people. So they work an extra 7 years.

But is it really a hard problem to solve?

We learned how to land rockets on drone ships, created map navigators that accurately predict ETA and built a car's autopilot that maintains a specific speed despite a road going up and down. These are feedback loop systems. There is nothing that prevents us from building a feedback loop system that can gradually bring our portfolio to zero by:

adjusting withdrawals year over year

changing investment risk in the portfolio

taking medical and life expectancy data into account

optionally using downside protection if portfolio success gets too low

Here's how we envision the process

We first build a financial projection to see all future income & expenses and Net Annual Cash Flow.

Using Net Annual Cash Flow, we estimate the annual deficit that needs to be covered from our savings:

When we set the initial fund allocation and contributions, we select the account types (taxable, tax-deferred, and tax-free). This allows us to estimate tax provisioning for withdrawals (represented as black bars).

Now we need to configure the initial fund size, contributions, and investment risk to gradually bring the fund to zero by the end of its life. For each financial goal the end of fund life would mean a different thing. For our goal (Financial Independence) we see that the fund needs to reach $4.6M in 2036 assuming the family can manage it properly and bring it to zero. $8.2M is not needed.

We test the fund in Monte Carlo Simulation and make sure we take the right amount of risk. If Monte Carlo shows a 100% success rate, we’re probably either over-saving or underinvesting. As an investor, we should take risks. Seeking a 100% guarantee of success often means paying a high cost and missing out on potential investment returns.

Congratulations - you’re now a fund manager!

Would you like to try this process yourself? Join Nauma